article for: Alt Energy MagBy Bill Shadish

Auditing Platforms for Energy Companies

-- What are our customers buying now? Usually, one of the first things that we are asked when discussing auditing applications is "What do we recommend for the device to use?". Well ... that is ... unless the very first question is "How much will it cost?" (ahem) This article will cover what "platforms" (see the Terminology sidebar) that our customers are now selecting for new auditing software installations. These customers range from energy, water, lighting and now solar auditing; spanning government agencies, independent contractors, to utilities, as well other types of ESCO's. There is a lot to this platform-thing; so to help with this, here is what we are seeing as platform trends; what our customers are picking, and why.

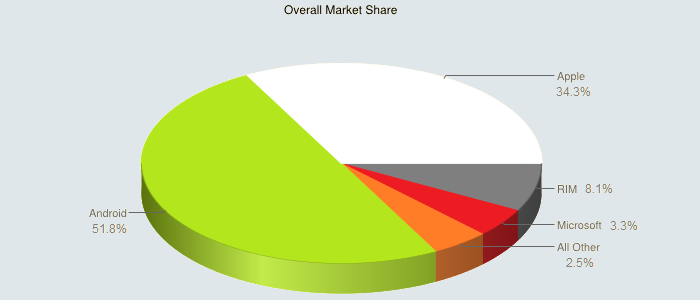

Next, is a look at what is being bought by others worldwide. Figure 1 provides a snapshot at what the current total market share is, by mobile operating system. In what was a US market once dominated only by Windows Mobile and Palm; things have changed dramatically. Apple (iOS) jumped out to a large lead, spurred mostly on iPhone sales; although their share has fallen off in the last year or so as Android is now the overall (and still gaining share) leader.  figure 1: 2012 Mobile OS Market Share The Biggest Losers: Microsoft, Nokia, RIM, Palm Microsoft, with a trail of fallen-by-the-way-side mobile OS -- like WinCE, PocketPC, Windows Mobile and others; continues to fall and now is betting on a two-pronged approach of reboot (again) and partner. The reboot component comes in restarting with yet another mobile OS (Windows Phone 8); while orphaning all of their previous users | prior app purchases | vendor applications along the way as previous versions of Windows Mobile apps will not run on the new one. The partnering component is with Nokia, with Nokia providing the actual physical phone hardware. Nokia, with the Symbian OS, once had more than ½ of the world's market share; although that was largely in Europe. They have since fallen to 5% in 2012; and have cast their lots with Microsoft in order to try and find a way to stay significant. But while the Nokia drop-off seems stunning, perhaps the biggest loser (er ... of market share), is RIM (Blackberry). Once a strong 20-30% of the market; and a cornerstone in many corporate infrastructures, and perhaps most importantly, carried by most corporate execs; users of RIM are dropping the platform fast, with only 4.1% of new users buying RIM devices. Major software players are killing their RIM versions, such as Google dropping GMAIL support for RIM, among many others. Finally, already gone is Palm. Once about ½ of the US market (and, yes, once about ½ of our foAudits installed base); the PalmOS morphed into the WebOS as part of their own desperate attempt to remain significant (see Microsoft/Nokia above for a current edition of this); was then bought out by HP, who then killed it off. In fact, the WebOS was raised-up and re-killed by HP again recently; as HP allowed the WebOS to spin off as an open platform; but won't let the WebOS run on the HP Touchpad devices that it was last seen on. So Palm/PalmOS/WebOS is an OS without significant hardware. As a side note, most of our previous Palm users are now running Android.

Table 1 -- Mobile OS Share What Our Energy Customers Pick -- The "PLATFORM" Our experience with choosing platforms has been a little different when working with energy organizations as compared to the overall market. This section covers the history of, and the current selections of, what our foAudits customers pick for the underlying audit platform. While we have suggested one platform or another over time; we are flexible, in that we have versions of foAudits for most of the major platforms, including Windows (all), Android, iOS, RIM Playbook (the QNX OS), Symbian, PalmOS, and browser-based versions. I say this just to point out that we do not pressure customers one way or the other when picking a platform; but we do recommend what we think will be best now, as well as over the expected lifetime of the application. Here is what our customers picked for platforms over the years. 1998-2002 These were the days of the Palm OS. Fast, simple and PDA-based (Smartphones without the phone capability). This was by far the dominant platform in the US, and accounted for 80-90% of foAudits installs. There really weren't any other mobile energy-auditing software applications at this time; so customers picked either the PalmOS, or went with laptops. 2003-2008 Windows Mobile remained bigger for us than in the general market, because it was driven by corporate purchases; which tend to favor the Windows world. The argument pushed by Microsoft was (and still is?) that if all of the desktops are running Windows apps; then the mobiles should run Windows for document and email compatibility. This was an argument that many corporate managers went along with; resulting in continued Windows Mobile purchases. Today however, the interoperability of documents argument is lessened because:

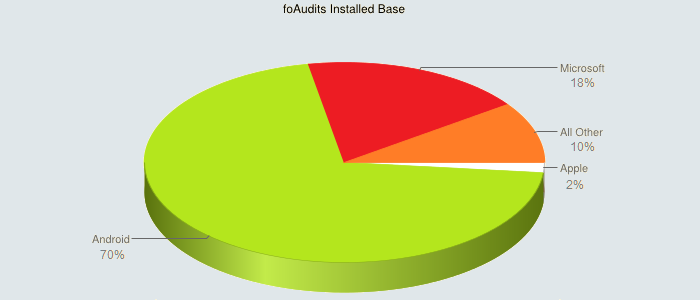

Also, most larger corporations adapt to market changes slower than smaller corporations; not to say that we didn't try to move them quicker -- See the Factors Affecting Change table below. Sales in this period were split generally 3 ways: Palm OS, Windows Mobile, and (non-platform) browser-based, for laptops. 2009-2012 Our current split of our customers' platform choices is shown in figure 2. These are the totals of what we now have in use, regardless of when the customer came on line. Rather obviously, Android has been the #1 selection for a few years. The relatively large slice for Microsoft is mostly from customers starting in the 2003-2009 timeframe, who picked Windows Mobile for the reasons shown above. The Microsoft slice Does include several variations of the Microsoft OS choices over the years, like Pocket PC, that is still in use. We are even still running a few customers on Microsoft WinCE, who are happy with what they have and are not ready to upgrade yet. All Other includes remaining PalmOS installs and some odd foAudits variants, like versions built for hand scanners. There are some RIM installs and things of that nature as well. There have been no new customers in the All Other bucket since 2009.  figure 2: All foAudits Mobile OS Installs. What they are buying right now While iOS has been all the rage, especially in the media the last 3 years, we have not seen as much demand for it from energy companies ... with what we have seen coming mostly from Canada. Some of this is due to the iPhone/iPad experience being more geared to the younger set; with a focus on games and multimedia. Some of this was due to cost; and more than a little of it was due to the relatively closed iOS platform itself. And yes, things like not permitting Flash to run and the early lack of a camera held back the iPad, at least in foAudits sales at first. The result was surprisingly few requests for Apple (iOS), with the slice of Apple shown in figure 2 being for iPhone-based audits. The arrival of Google's Android on smartphones and tablets pushed Apple along, and also provided lower cost alternatives, with some interesting features of their own; like cameras(!), sometimes more than one; HDMI connections and, yes, even Flash support. The ease of getting Android apps into the Google market spurred Android to its current top position. There have been other recent platforms attempted, like the WebOS-based HP Touchpad, and the QNX-based Playbook from RIM. The Playbook in particular looked like a nice alternative (and there is a foAudits version for it) but, like WebOS, Samsungs' BADA and other more recent platform introductions -- the Playbook suffered from poor marketing and a dearth of applications. Microsoft tries and tries again, but seems to have lost the chance that they had back when the market was split between just Windows Mobile and Palm.

Today, most of our customers pick Android, and Android 4.0+ at that.

Second choice is iOS, and the third choice is browser-based for any type of device -- but only if being connected at all times is not a requirement. What Our Energy Customers Pick -- The "FORM FACTOR" Up until the iPad, the choice used to just be laptop versus phone/pda versus very expensive -- as in $2,000+ expensive -- tablets. But the iPhone and iPad provided an interesting choice, and also ushered in a swell of devices from other vendors, including affordable tablets. There are now smartphones, affordable tablets, "smart" GPS devices, "smart" barcode readers; electronic writing-to-text pens and pads; as well as the previous laptops and netbooks. Of course the smartphones and tablets also have GPS and bar-coding capabilities now too. Tablets vary in size from 5", to 7", to 8.9", to 10.1"+. All of this, with many different variations of these, from many different vendors. The line between smartphones and tablets is starting to blur too; since there are cellular-enabled versions of tablets that you can make calls from; and phones with screens 5.3"+ in size. In most cases, the same operating system runs on both phones and tablets now. Tablet prices that began at $599 a few years back, now are in the sub $400-range, with much superior features to boot. The Google Nexus 7" at $199 may erase any concerns that equipping a field staff with devices is too expensive. This well may be the first "Happy Time" for platform pickers.

Today, most of our customers pick Wi-Fi 10.1" tablets with Gorilla glass.

Actual synchronization of data to the servers is done at home or the office. The second, more distant choice is a smartphone with physical keyboard and a 4.7-ish screen. Factors Affecting Change One thing that needs to be addressed is whether the organization is ready to consider a new platform at all. Table 2 shows a basic set of modifiers, that when totaled up, help to show if change is even possible. If your total is +1 or less, then it's likely that the organization will want to stay put with the platform that they have in place now. It is sometimes interesting that even if the organization is not thrilled with the platform that they have; they are likely to stick with it going forward (hence the -1), because change is rarely preferred. And to be fair, there is cost to replacing the platforms that they already have -- even if they don't love them -- and this cost is often enough to erase any desire for change.

Table 2 -- Chance for Change Modifiers NOTE that the platform the company starts with, might even be "Pen and Paper". If after adding up your modifiers you are sitting at -2 or worse; it is likely that they will be sticking with pen and paper [or whatever their current platform is] regardless if the organization is talking about change or not. On the plus side (literally), if your total is 4 or more, then it is likely that the organization is both ready for, and will be accepting of a new platform. For More Information foAudits, mobile energy audits Tips for setting up Mobile Application Interfaces APP versus Browser-based applications Author Bio Bill Shadish has been working with (ok, and evangelizing) mobile energy audits for commercial and residential applications since 1998. He created and still manages foAudits (www.foAudits.com), the very first mobile energy audit platform; and has written over 250 articles for both print and online readers. Bill is now working on solar panel tools that will be incorporated into foAudits in 2012. You can reach Bill at http://foAudits.com?screen=contact. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||